One of the current trends with insurance companies is to try to save themselves money by tricking auto collision injury victims into settling their cases before they even have had time to understand the full extent of their injuries. State Farm calls it their “early offer.” But what victims need to know is that this “offer,” if accepted, is a full and final resolution of all bodily injury and medical claims you may have now or in the future, whether you know about them or not. So whether you are filing a State Farm accident claim, a Farmers Insurance claim, or filing a claim with some other insurance company

What is an Early Offer?

What is an Early Offer?

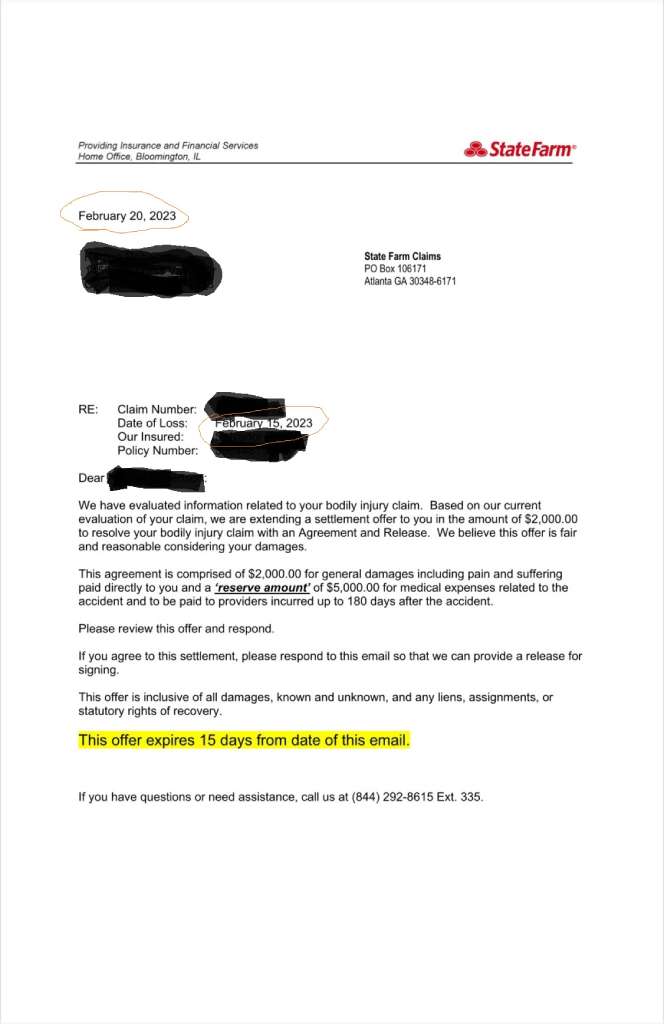

An early offer is a letter by an insurance company offering to settle an automobile accident victim’s claims for bodily injuries and medical expenses known and unknown. State Farm Insurance is known for sending these to claimants.

On the right is a recent example of an “early offer” that was received by a person who was injured in an accident caused by a State Farm insured. Note for the dates that it was sent just five days after an automobile accident. The offer also places a 15-day period in which the victim must accept it or it will expire. This added clause can make the victim feel pressured into accepting the offer out of fear that it will go away and they will be stuck paying their bills out-of-pocket.

What Happens When I Accept an Early Offer From State Farm?

When you accept an early offer from State Farm, they pay you the initial promised lump sum amount and they pay off your past medical expenses up to the medical coverage amount stated. They also pay for future expenses until all bills total the stated medical coverage amount or the 180 deadline runs–whichever comes first. You are responsible for all bills after the earlier of the above limitations expires and you cannot make any additional claims for medical expenses, pain, suffering, mental anguish, scarring, disfigurement, or disability.

What If My Medical Bills Exceed the Amount Set Aside for Medical in the Early Offer?

If you accept the early offer and the early offer states a maximum amount that they will pay for all of your medical, then you are responsible for the balance of your medical bills that exceed the stated maximum amount.

Accepting an Early Offer is Like Flying Blind

Because the early offer is typically made very early, even days after the wreck, and it has a short time in which it must be accepted, the victim is basically making a decision about their health without having all the necessary information. Common whiplash injuries that arise from an auto collision may not even fully manifest themselves within the first few days. Moreover, they can get worse over time, particularly if not tended to. Many accident victims make the mistake of trying to just “tough it out” thinking that the pain will go away. When it gets worse instead of better, having accepted an early offer can preclude a whiplash victim from getting the medical care reimbursed. if the pain gets progressively worse and ultimately requires expensive medical care, they are stuck covering the bulk of the bills out of their own pocket. You should not consider any offer until you are 100% recovered or your doctor has placed you at maximum medical improvement.

Does an Early Offer Have to Be In Writing?

No. Any offer to settle your case, early or late, does not have to be made in writing to be binding. If you verbally agree to accept an offer to settle any or all of your claims and you are an adult, you are bound to accept the terms of the offer. For more reading on this, please read: Verbal Settlements Are Binding.

What Other Types of Early Offers Are There?

Recently, we had another insurance company make their own version of an early offer by telling an injured car accident victim that they wanted to pay her chiropractor’s bills directly for her and PayPal her $1,000.00 for her troubles. They then sent her “an authorizing document” via DocuSign to be signed using her phone. Once she signed the “authorizing document,” she got a copy emailed to here which was much easier to read. It was a release of all of her claims in exchange for the payment.

What Should I Know Before Signing Any Settlement?

Before you agree to any settlement, you should know these things:

- Any medical bills paid for by health insurance, Medicare, or Medicaid creates a lien that must be reimbursed in favor of the payor out of your settlement funds.

- Any unpaid balances on the medical bills are your responsibility.

- Any bill incurred by a hospital or any emergency room physician within 72 hours of the accident must be paid out of your settlement proceeds directly by the auto insurance company if they filed a notice of an emergency medical lien in the country records.

- Any future medical expenses are your responsibility unless the settlement release/agreement specifies otherwise.

Before you sign anything from an insurance company, you should have it reviewed by a lawyer.

Don’t Be Fooled by Tricky Insurance Settlement Tactics

The above examples of how insurance companies get people to sign away their rights before they have all of the relevant and necessary knowledge at hand to make an informed decision. Talk to a lawyer whose job is to look out for your rights before you sign anything the other driver’s insurance company sends you. Simmons and Fletcher, P.C., Injury & Accident Lawyers have been representing accident victims exclusively since 1979. We provide free consultations and charge no attorneys fees or attorney expenses unless we make a recovery for our clients.